Stablecoins have evolved from individual collaterals backed by cash reserves and T-bills to stables backed by crypto assets.

Despite the win in which a stablecoin might decide to fall, whether fiat-backed, algorithmic, or crypto-backed, the main goal is the sustainability of its price over time alongside other parameters.

This article outlines Resolv’s stablecoins - USR and RLP, its dual-token architecture, pegging mechanism, potential risks, and what Resolv is introducing to mitigate them.

Moving forward….

An Introduction to the Resolv Ecosystem

Resolv Labs is a protocol designed with a dual-token model and full collateralization for its stablecoin. Both tokens serve different purposes in the ecosystem—one for low risk and low reward with respect to the latter) and the other for high risk and high reward (with respect to the former).

Its core stablecoin, USR, is an over-collateralized stablecoin with a 170% ratio, hence ensuring a liquidity buffer to the stablecoin minted to prevent its tokens from liquidation.

On the other hand, RLP, another stablecoin, serves as an insurance token layer. This token employs delta-neutral strategies between perpetual contracts and spot trades traded against collaterals to be rewarded through funding rates.

In the case of risk mitigation, RSL backs USR up from its underlying collateral to ensure that its price remains pegged at 1:1 for every token minted and redeemed.

How Resolv labs operate;

For every stablecoin deployed, three things are kept at the top of the mind to be achieved: price stability, capital efficiency, and decentralization.

Hence, different forms of stablecoins have emerged, from fiat-based stablecoins to algorithmic stablecoins, employing different strategies to maintain its price stability and an example such as USR, which operates with delta-neutral strategy.

Some stablecoins have failed, such as UST, were backed partially by crypto assets and cash reserves. However, in the long run, as these crypto assets, being volatile, lost their value tremendously, the minting ratio reduced, and current holders couldn’t attest that 1 UST remains 1 USD (which, of course, is stringent in capital efficiency and will be discussed soon).

Price stability sustains a stablecoin's peg over a long period, which is deeply influenced by the collateral/minting possibility design.

Price stability of USR is guaranteed in two ways;

Over Collateralization.

RLP, as a liquidity buffer.

Over-collateralization is a pegging mechanism which can be enabled in various ways. It ensures that more collateral is given to mint it a stablecoin.

USR maintains a 1:1.7 ratio for stablecoin given for every collateral pledged to get the stablecoin, although USR cannot only be held through minting. For users refusing to opt for the KYL/AML process, USR can be bought in the secondary market.

USR can currently be minted through traditional stables serving as collateral, and in the long run, ETH would also be used as collateral. So, let’s say an institution decides to mint $7.000.000 worth of USR; $11.000.000 worth of the tokens are given off as collateral.

80% of these traditional stablecoins given as collateral are converted to ETH for hedging and staking from the collateral pool. The RLP—Resolv Liquidity pool is a liquidity buffer while delta trading occurs. As USR remains 170% backed, the excess collateral is allocated to RLP for delta-neutral trading, where funding rates come in as a reward.

Controversies of laying out of opportunity cost may be given as these excess collaterals (which makes it 170% collateralized) can be used to gain yield elsewhere, as it isn’t wholly capital efficient (check out the section on capital efficiency to understand why this may not be the case)

On the other hand, Decentralization matters;

This can be regarded as the absence of a third party to control the movement of monetary resources or the availability of resources used for the stablecoin’s operations, which slightly makes Resolv Labs not 100% fully decentralized.

This is noted during the delta-neutral implementation, regarded as trading perpetual contracts and spot trades simultaneously, where both trades move in the opposite direction.

This activity creates dependencies on centralized entities. In the case of Resolv, linear and inverse contracts are both used on Binance, Deribit, OKX, and Bybit. Provided these platforms are centralized, the risk ratio becomes high in a case of when there are open positions during an unprecedented platform exploit.

On the other hand, integrations to the collateral pool have been extended to Hyperliquid, one of the best products to find its PMF (product market fit) so far this cycle, and this improves the yield users could be rewarded with.

In this course, decentralization is a bit restored.

Capital efficiency is another crucial factor in determining how much collateral is placed before minting occurs. If more collateral is needed to mint 1 USR, which is equivalent to 1 USD, then it is regarded as capital inefficient, and if less is required, then it is capital efficient.

Capital efficiency is mutually exclusive to price stability as it affects the sustainability of the stablecoin.

Capital efficiency is disparate for RLP and USR, as collateral for RLP depends on its current price while USR remains constant at 1:1.7 (as explained already). Although USR requires more collateral to maintain its ratio, capital efficiency expands as yield generation is maintained through funding rates and staking.

How Yield is generated and distributed

The yield generated by Resolv is gotten through two ways:

ETH Staking.

Funding rate generated by perp futures positions.

Generally, when minting occurs, a collateral pool already set up is held in two positions:

An institutional wallet - where the trading margin is kept to open futures and spot positions.

An on-chain smart contract-linked wallet - where most of the ETH collateral is held for redemption, and a fraction is used for staking purposes.

ETH staking is already known as a way to add to the economic growth of Ethereum at large while being incentivized for the security contribution. This contribution is reflected in APYs.

On the subject matter of capital efficiency, part of this pool, which makes 80%+ of on-chain assets (ETH and stablecoins), is staked into 3 different liquid staking protocols:

Lido, with wstETH as the LST

Binance, wbETH as the LST and;

Dinero, apxETH

With 70%, 15%, and 15%, respectively, for the protocols, while these returns from staking are directed towards holders of stUSR (staked form of USR which is the only way to gain yield through USR and this can be done on the resolv platform).

These yields are obtained by borrowing ETH against staked ETH, as only staking ETH requires a 3-day withdrawal delay.

Upon distribution three epochs are factored; Base Epoch, risk premium, protocol fees which are rewarded respectively to holders of staked USR vaults and RLP, exclusively to RLP, and to the protocol treasury.

Delta-Neutral trading - How funding rate is calculated and paid

Despite that delta-neutral trading can be done linearly and inversely. Keep in mind that Resolv holds short positions.

As explained, two positions are opened during delta trading: one on spot and another on Perps.

Perps is the price of the underlying asset as a higher misprice. Based on market conditions, most times in bullish seasons, the perps price of an equivalent asset is always higher than its spot price.

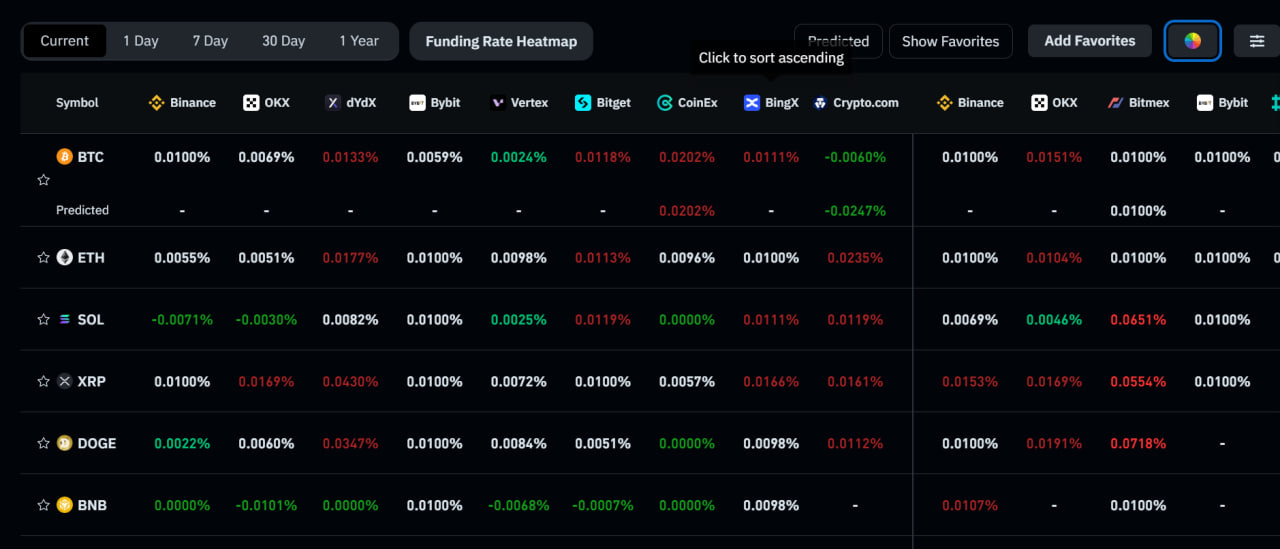

This mechanism, funding rate, employs a mechanism where the last traded price is always anchored to the global spot price, and can be seen on Coinglass. It is a mechanism used to peg the price of the perps to the spot. It is a mechanism is introduced for the rebalancing of short and long positions.

For ETH funding rate as show below;

It differs for each exchange. To calculate, using an exchange like Binance (since Resolv uses this).

The funding rate is 0.0082% with an 8-hour interval. To calculate how the funding rate is paid:

Funding rate X interval X 365 days (1 year) to get the APY.

0.0082 x 8 x 365 = 23.9% APR

This APR changes based on market volatility. But historically, market positions has been positive for short positions, which Resolv does through the RLP pool and get paid for the funding rate and this funding rate is paid out to the RLP. In other market responses, during the 24-hr period, if the funding rate goes negative for short positions, RLP bears the loss.

How USR and RLP work in tandem

In DeFi and finances, there is generally high risk and high reward and low risk and low reward. RLP is set and designed as the insurance layer of USR for counterparty risk to stabilize the collateralization ratio or risk in the futures market.

Take a look at RLP as a bonker in a military zone where, for instance, an explosion is to occur. Everyone runs inside, takes cover, and after the explosion, everyone is safe. “Everyone” in this context is USR. RLP bears the loss and any possible loss that can affect a stablecoin.

The RLP position is about 40% of the entire collateral basket. If the funding rate gets drastically negative in the bull market, the margin is set at liquidation, and the RLP position pays for that with nothing affecting the USR position. This is one reason why the reward of RLP compensates for the risk greater than USR.

USR has only holders and stakers (who get back their yield with the ETH staking). If USR's collateralization is lower than 110%, then redemptions of RLP are suspended to buffer the collateralization of USR so that users can redeem. As said, the higher the reward, the higher the risk, and the lower the risk, the lower the reward.

Risk involved with Resolv Ecosystem

Market Downturns: Although historically short futures positions have been paid, in a bull market, the case seems to be the opposite, as the long positions end up being paid. This can affect the yield which RLP directs to its holders and, at the same time, the revenue the protocol is likely to generate.

Possible change in funding rate: As seen in the second image of different centralized exchanges, the funding rate is different for every exchange this as well gives a subtle demonstration that it changes and when this funding rate changes it affects the possible APRs any position can get and this can incure a masssive liquidation event.

But on the other hand, Resolv uses high liquidity exchanges to lower risk of less insolvency.

Centralized exchange risk: Exploits on exchanges have been, and the certainty that even the best-centralized exchanges have a secure system isn’t guaranteed, leaving Resolv at another risk but Resolv lowers this risk by depositing the collaterals not directly but with third party custodians which as well still barriers the factor of decentralization.

Conclusion

Resolv Labs using a dual-token model bootstraps the effect of USR being sustainable for holders, short term conversion and steps up the game generally for stablecoins. At the moment of writing, Resolv hits new all-time-high (ATH) in its TVL from $150M to $200M indicating adoption and growth in its ecosystem.

More integrations will be done to its collateral pool to decentralize where yield is gotten from; hence, development on the Resolv ecosystem will continue. If you’re interested in providing liquidity, Spectra Finance’s fixed rate would be a good bet, as would providing it to Aerodrome.

It's just Day 1 of Resolve Labs, and you can join their socials on X, Discord, etc. to follow up on Epoch points and try out Resolv’s Dapp.